How to Buy Property in Mérida as a Foreigner (2025)

Mérida stands as Mexico’s most stable and rewarding investment market, blending exceptional safety, strong property appreciation, and a globally recognized quality of life. The region offers compelling options for the discerning investor: from colonial heritage in the Centro Histórico to modern luxury in the Northern suburbs and high-demand beachfront properties along the coast.

For those looking to diversify their portfolio or establish a strategic base, Mérida promises strong ROI, stable rental demand, and remarkably low holding costs. Success, however, relies on clarity and strategic execution.

Step 1: Align Your Investment Goal with the Right Micro-Market

The first, most critical decision is defining your "why." Your goal—whether it's long-term residency, seasonal cash flow, or pure capital preservation—dictates where you should focus your search:

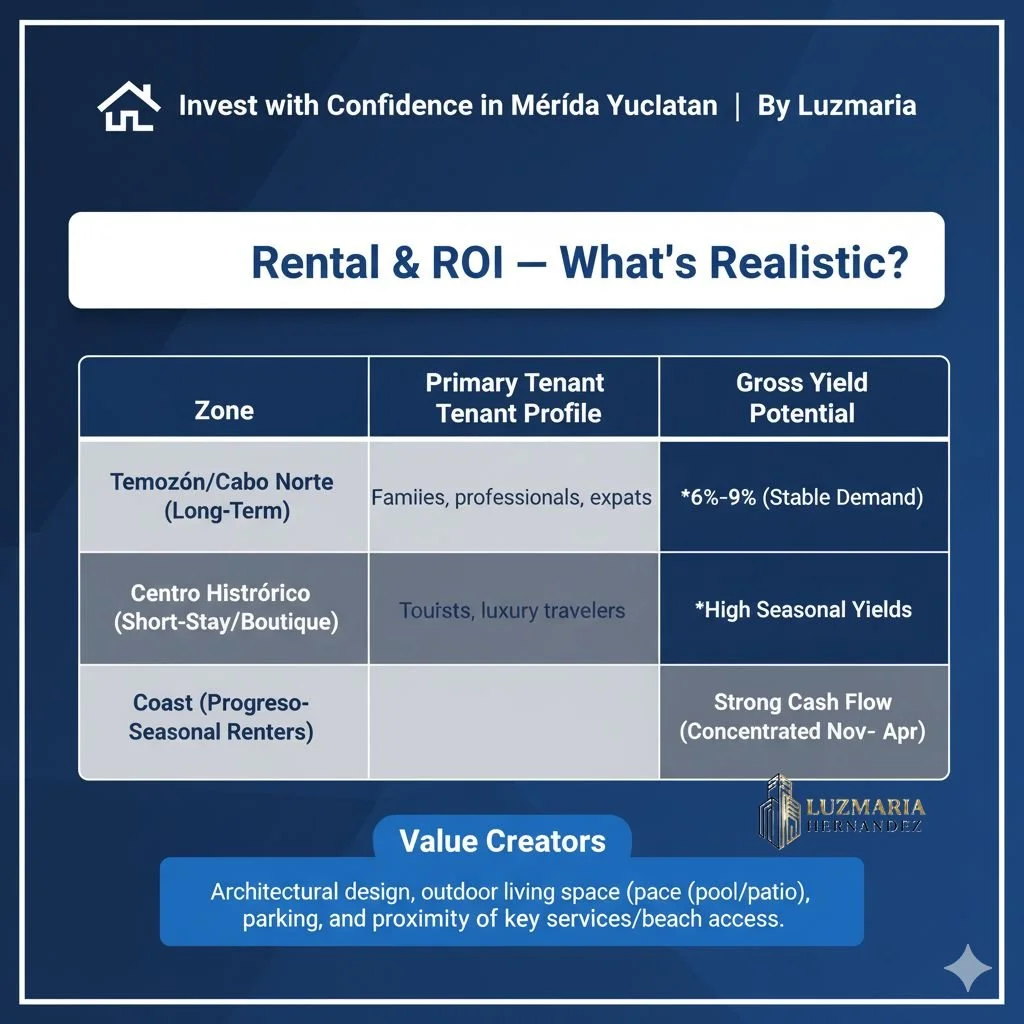

For Capital Appreciation & Lifestyle: Target the booming North—Temozón Norte, Cabo Norte, and Montebello. These areas offer modern, secure gated communities, proximity to the city’s best schools and hospitals, and are highly attractive to long-term professional tenants.

For Exclusivity & High-End Liquidity: The Yucatán Country Club remains the pinnacle of luxury, offering golf estates and resort amenities that command premium resale values and attract an elite tenant pool.

For Short-Stay Income & Heritage: The Centro Histórico is ideal for boutique rental income. Design-led colonial homes with courtyards and pools yield strong seasonal rates, offering robust annualized returns despite higher management needs.

For Seasonal Cash Flow & Beachfront: The coastal corridor of Progreso, Chicxulub, and Telchac is dominated by peak season demand (November–April). Investing here requires balancing owner-use with strong seasonal rental yields.

Investment Mandate: Define your full-time, part-time, or income-only strategy upfront. This decision is the filter for evaluating property types, HOA rules, and projected returns.

Step 2: Mastering Foreign Property Ownership (The Fideicomiso)

Because Mérida and the Yucatán coast fall within Mexico’s "restricted zone," foreigners secure full, fee-simple ownership rights through a Fideicomiso (Bank Trust). This is the standard, secure, and legal path:

The Mechanism: A Mexican bank acts as the trustee, holding the title, while you are the beneficiary with absolute rights to use, rent, sell, or bequeath the property.

The Cost: Expect a one-time setup fee of roughly USD $2,000–$3,000, with an annual trust fee ranging from USD $500–$700.

The Takeaway: The fideicomiso is a routine legal framework that does not limit your ownership—it merely complies with Mexican constitutional law.

Step 3: Building Your High-Performance Acquisition Team

A successful and safe transaction requires more than just a listing agent. Assemble an "A-Team" of local professionals who represent your interests:

Licensed Buyer’s Agent: Essential for market access, comps analysis, negotiation strategy, and identifying red flags.

Real Estate Attorney: Crucial for contract review, title verification, and drafting protective clauses specific to your investment.

Notario Público: A government-appointed public official who formalizes the deed, ensures all taxes are paid, and officially records the transaction.

Inspector/Contractor: Highly recommended, especially for historic or beachfront homes, to verify structural integrity, moisture control, and electrical capacity.

Accountant/FX Advisor: For optimizing large currency transfers and ensuring tax compliance if you plan to rent.

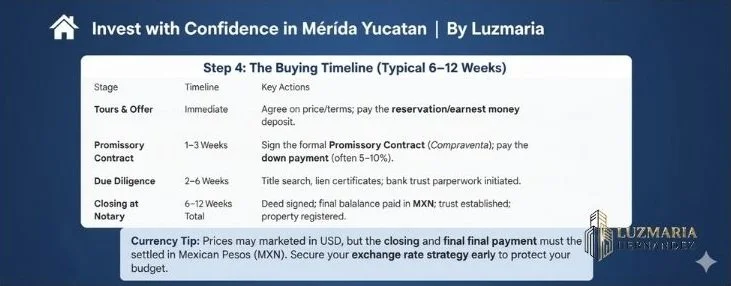

Step 4: The Investment Timeline and Currency Strategy

The acquisition process typically moves through several phases, culminating in a closing that generally takes 6 to 12 weeks.

Step 5: Essential Due Diligence and Risk Mitigation

Never skip the diligence phase. Your team must confirm the following essentials to de-risk your investment:

Title Clarity: The title must be clean and free of any liens, encumbrances, or disputes.

Land Status: Confirm the land is titled (not ejido) unless you are working with a developer who has fully privatized and cleared the title.

Permit & Zoning: Verify that condo bylaws and local zoning permit your intended use (e.g., short-term rentals).

Technical Integrity: For older or coastal homes, a full structural and moisture inspection is non-negotiable to identify potential salt-air corrosion, drainage issues, or roof sealing problems.

Contract Safeguards: Ensure your contract includes clear timelines, penalties/refunds, and a firm clause addressing currency handling.

Step 6: Maximizing Your ROI—Financing and Yields

Mérida’s market is dominated by cash buyers, which often allows for greater negotiation power, especially in pre-sale or distressed scenarios. Cross-border financing is limited, meaning most investors leverage equity from their home country.

Optimal Strategy: Cash purchasing combined with negotiating pre-sale discounts and value-add improvements (like adding a pool or a smart home system) typically yields the strongest returns here.

Realistic Gross Rental Yields (Annualized):

Final Step: Post-Closing Compliance and Management

Once the deed is signed, establish your final compliance:

Administration: Transfer utilities, pay the annual fideicomiso fee, and remit the annual Predial (property tax).

Tax Compliance: If renting, you must register for tax filings in Mexico. Keep meticulous records, as many expenses (HOA, repairs, management fees) are deductible.

Estate Planning: Consider mirroring the heirs named in your trust with a local will for streamlined succession.

Management: Engage a reliable, professional property manager if you reside abroad, particularly for high-turnover short-stay rentals.

Invest with Confidence in Mérida Yucatan.

I specialize in guiding investors through Mérida’s lucrative real estate landscape, ensuring every step is secure, transparent, and profitable. From defining your strategy to finalizing your ownership, partner with an expert who understands this market's unique potential.

Ready to transform potential into tangible returns? Contact me today.