Mérida vs. Riviera Maya — Comparing Real Estate Opportunities

When it comes to real estate investment in Mexico, two names stand out: Mérida and the Riviera Maya.

While they share the same Yucatán Peninsula and tropical charm, they offer very different investment profiles.

Choosing between the two depends on what kind of investor you are — one seeking stability and long-term appreciation, or one chasing tourism-driven cash flow. Let’s explore both.

🌆 1. Mérida – The Stable and Sophisticated Market

Mérida, the capital of Yucatán, has evolved into one of the most stable real estate markets in Latin America. Its combination of safety, affordability, and growing infrastructure makes it ideal for investors who prioritize steady returns and peace of mind.

Investment Highlights:

8–12% annual property appreciation.

Strong demand for residential rentals and relocation homes.

Low property taxes and maintenance costs.

Safe environment for families and retirees.

Popular areas such as Temozón Norte, Cabo Norte, and Yucatán Country Club offer luxury homes and modern condos within minutes of top schools, hospitals, and shopping centers.

Ideal for: Long-term investors, retirees, families, and professionals seeking stable ROI and lifestyle balance.

🌴 2. Riviera Maya – The Dynamic and Tourism-Driven Market

Stretching from Cancún to Tulum, the Riviera Maya thrives on tourism and short-term rental demand. Investors here enjoy higher cash flow potential — but with greater volatility and competition.

Investment Highlights:

10–15% ROI in high-season short-term rentals.

Rapid property turnover driven by tourism.

Oceanfront and resort-style developments with global visibility.

Higher costs: maintenance, property management, and competition.

While the Riviera Maya offers excitement and luxury, its market can fluctuate depending on tourism and external factors like airline demand or hotel oversupply.

Ideal for: Active investors, Airbnb operators, or those seeking beachfront exposure with quick returns.

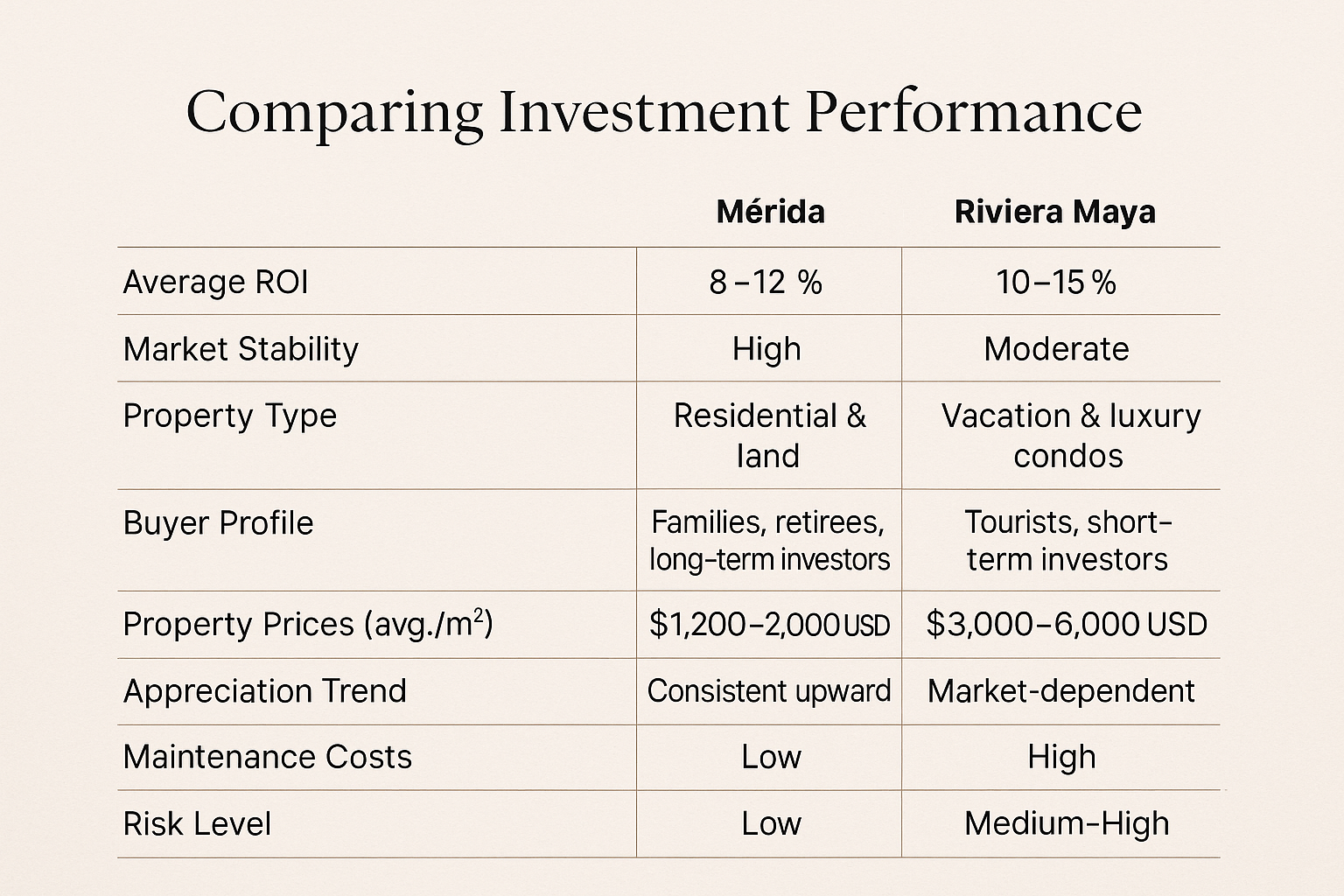

🏡 3. Comparing Investment Performance

💰 4. Which Market Offers Better ROI?

While the Riviera Maya offers faster short-term returns, Mérida provides long-term wealth growth.

Investors looking for capital appreciation and lifestyle security prefer Mérida’s residential and land market.

Those who prefer rental yield and tourist-driven income may find opportunities along the Riviera.

A balanced strategy?

Diversify: own a stable home in Mérida for capital growth and a rental condo near the coast for cash flow.

🌅 5. The Future of Both Markets

Mérida: Supported by urban planning, tech industry growth, and the Tren Maya, connecting it to Cancún and Campeche.

Riviera Maya: Continues to attract international developers and digital nomads, but faces environmental and regulatory pressure.

As the peninsula develops, investors can expect Mérida to become the “economic heart” while Riviera Maya remains the “tourism jewel.”

In Conclusion

Both Mérida and the Riviera Maya represent opportunity — one through stability, the other through velocity.

The key is knowing your goals: long-term wealth, steady income, or both.