How to Finance a Property Purchase in Mexico (Mortgages & Alternatives)

Buying a home in Mérida, Yucatán or anywhere in Mexico is a dream for many foreigners. Whether you’re relocating, investing, or looking for a vacation property, understanding how financing works in Mexico is key. The process is different from the U.S. or Canada, but with the right guidance, you can secure a property safely and smartly.

This guide explains the main mortgage options in Mexico for foreigners, the alternatives available, and what to expect when financing your first property in Mérida or the Riviera Maya.

1. How Property Financing Works in Mexico

Foreigners can legally buy property in Mexico, including Mérida and Yucatán, through a bank trust (fideicomiso) or Mexican corporation.

Mortgages in Mexico are available in Mexican pesos (MXN) and sometimes in U.S. dollars (USD).

Most loans require:

20–30% down payment

Proof of income (foreign or local)

Good credit history

2. Mortgage Options for Foreign Buyers

Several Mexican banks and lenders provide mortgages for non-Mexican citizens:

BBVA México – Offers peso-denominated loans, often requiring residency status.

HSBC México – Provides mortgages for foreigners with a valid FM2/FM3 visa.

Scotiabank México – Has international banking connections useful for Canadians.

Specialized lenders (such as Moxi and Cross Border Xpress) – Designed for U.S. buyers, with options in USD.

💡 Tip: Mortgage terms in Mexico are usually shorter (10–20 years) and interest rates are higher than in the U.S. or Canada.

3. Alternatives to Traditional Mortgages

Not every foreign buyer uses a bank mortgage. Other options include:

Developer Financing – Many new projects in Mérida and Riviera Maya offer flexible payment plans.

Seller Financing – Some private owners accept partial financing directly.

Cash Purchases – Still the most common, especially for retirees or investors.

Home Equity Loan (in your home country) – Using your U.S. or Canadian property to fund a Mexican purchase.

Co-Investment – Partnering with family or friends to acquire investment properties.

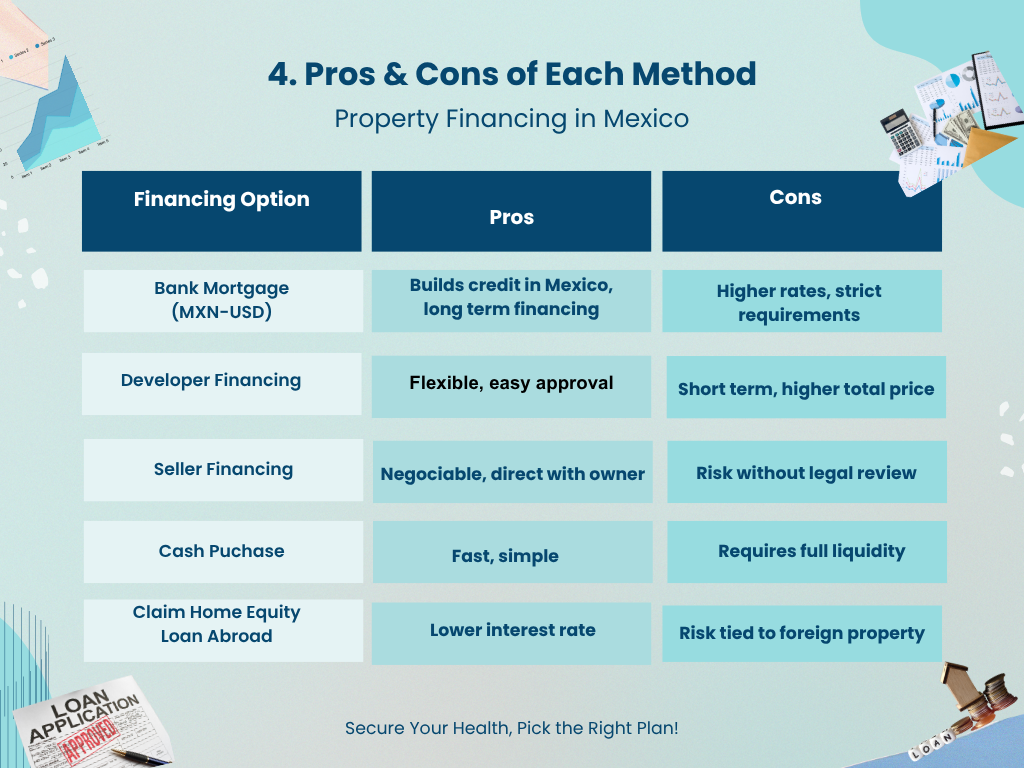

4. Pros & Cons of Each Method

5. Legal & Tax Considerations

In restricted zones (like Mérida, Yucatán), foreigners buy through a fideicomiso with a Mexican bank.

Closing costs are typically 5–8% of purchase price.

Annual property taxes (predial) are very low compared to the U.S./Canada.

Always hire a notario público (government-appointed attorney) to certify the transaction.

6. Common Mistakes to Avoid

❌ Not checking financing eligibility early.

❌ Assuming U.S./Canada mortgage rules apply.

❌ Skipping legal due diligence.

❌ Forgetting currency exchange and tax implications.

✅ Conclusion

Buying property in Mérida and the Riviera Maya is absolutely possible for foreigners. With the right mortgage or financing alternative, you can relocate, retire, or invest in one of Mexico’s most attractive markets.

As a bilingual real estate advisor in Mérida, my mission is to guide you step by step, making your investment safe and successful.

📲 Contact me today to explore the best financing options for your property in Mérida or Yucatán.