“Understanding ROI in Yucatán Real Estate: What Investors Can Expect”

Modern residential area in Mérida Yucatán with ROI graph overlay — real estate investment Mexico.

Investing in real estate in Mexico’s Yucatán region — especially in Mérida — has become one of the most strategic moves for investors seeking both security and long-term growth. With a combination of affordability, demand, and continuous development, the ROI (Return on Investment) in Mérida real estate is outperforming many traditional markets across Latin America.

💡 1. Mérida’s Market at a Glance

The Yucatán real estate market has experienced annual appreciation between 8% and 12% in the last few years. This consistent growth is driven by:

A surge of foreign investment from the U.S., Canada, and Europe.

Infrastructure improvements (including the Tren Maya and new business parks).

High domestic demand from Mexican families relocating from other states seeking safety and quality of life.

Neighborhoods such as Temozón Norte, Cabo Norte, Altabrisa, and Montebello have seen particularly strong growth, becoming the epicenter of Mérida’s luxury and residential expansion.

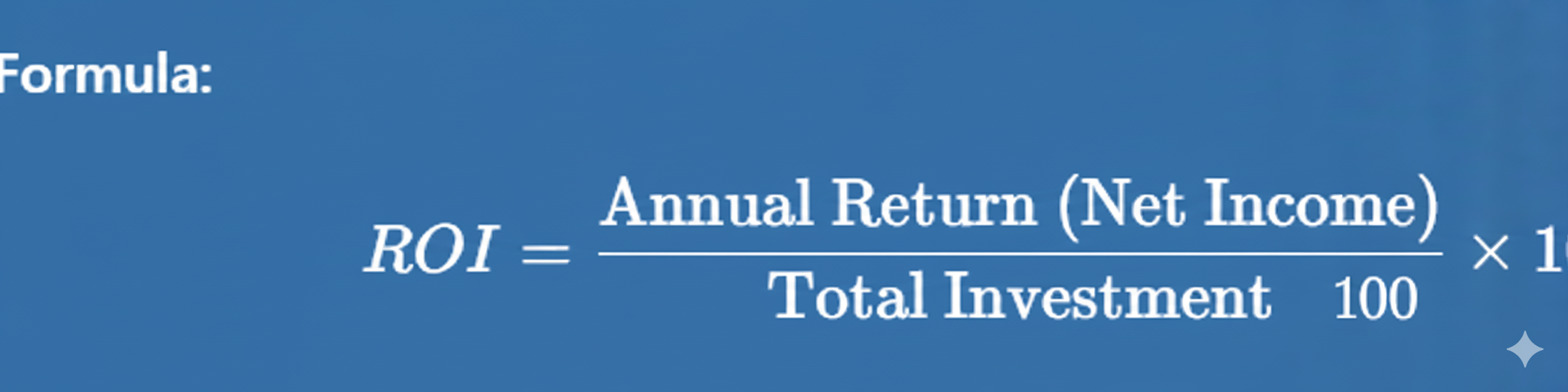

📊 2. Understanding ROI (Return on Investment)

In real estate, ROI measures how effectively your investment generates profit compared to its cost.

For example:

ROI Formula:

In Mérida, investors can expect:

Rental ROI: 6% to 10% annually for long-term rentals.

Vacation Rentals (Airbnb/short-term): up to 12% annual yield in tourist-favored zones like Centro Histórico and Progreso.

Land appreciation: up to 15% yearly in developing areas such as Conkal and Komchén.

These returns are higher than many North American or European markets, where average yields often hover between 3% and 6%.

🏘️ 3. Key Drivers of High ROI in Yucatán

a. Safety and Stability

Mérida’s reputation as the safest city in Mexico attracts families, retirees, and digital nomads, ensuring steady rental demand and strong resale value.

b. Infrastructure Development

Major projects like the Tren Maya, Yucatán Country Club expansions, and industrial zones near Hunucmá and Umán continue to strengthen long-term appreciation.

c. Booming Tourism and Digital Nomads

Mérida has become a year-round destination, with high hotel occupancy rates and growing Airbnb demand — fueling the success of vacation rental properties.

💰 4. ROI by Property Type in Mérida

By aligning your goals — cash flow vs. long-term equity — with the right property type, you can achieve a balanced portfolio in Yucatán’s expanding real estate market.

🌞 5. Example: ROI Projection in Temozón Norte

Let’s say you invest $250,000 USD in a modern home:

Annual rental income: $20,000 USD

Annual maintenance + taxes: $3,000 USD

Net annual return: $17,000 USD

ROI: ≈ 6.8% per year

Add appreciation (about 10% annually), and your total gain could reach 16–17% yearly — a rare combination of passive income and capital growth.

🧭 6. The Smart Investor’s Strategy

The best results come from a long-term vision. Many successful investors:

Diversify across land, residential, and rental assets.

Work with a licensed advisor (to avoid hidden pitfalls).

Prioritize areas with infrastructure, schools, and commercial expansion.

Mérida rewards patience and smart selection — not speculation.

💬 Final Thought

The ROI in Yucatán real estate is more than a number — it’s a reflection of Mérida’s evolution into a modern, secure, and globally desirable city.

For investors seeking stability, value, and peace of mind, Mérida stands as one of the most promising real estate destinations in the Western Hemisphere.